Understanding Your ConEdison Bill in New York State

This page describes the tariffs and the bill structure for residential customers with Con Edison. We give you an example of a Con Edison Electricity & Gas bill, and offer some tips on how to save money with Con Edison.

How to Save Money on Your Con Edison Bill

With electricity prices rising each year, here are a few ideas for taking the pressure off your energy budget.

Save Energy

The most effective change you can make is to reduce your overall energy consumption. A lot of the items on your Con Edison bill are charged on a per kWh basis, so improving your energy efficiency at home can go a long way towards lowering your bills.

Energy Saving Ideas Check out some of our useful tips about how to save money on your energy bills, including how to save money in the summer, how to use your appliances wisely, and all about a little thing called vampire energy

Pay a Lower Rate

Another option you can take is to take a look at the rate you're paying with Con Edison, and see if it can be beat by an alternate energy supply company (ESCO). With electricity markets in New York open to competition, many alternative suppliers can offer competitive rates for electricity and natural gas. Shop around - you may find a better deal with an ESCO!

To learn more about energy supply options in your area, check out our pages on energy in New York, or call us directly at phone currently not available to find the best rates in your area.

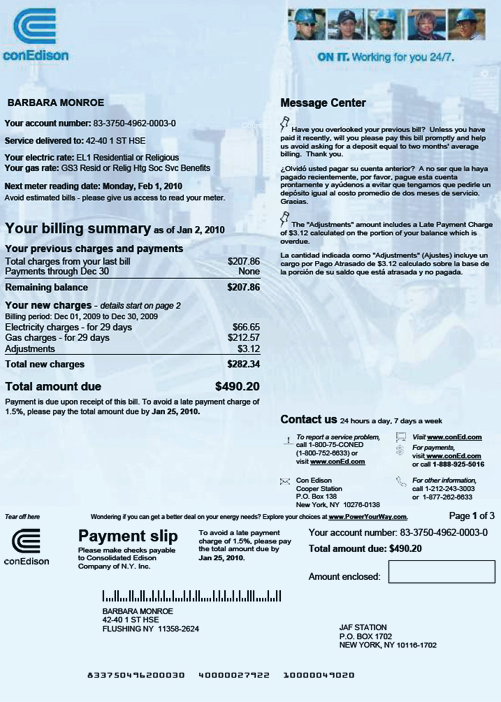

Example of a 2010 Con Edison bill - Page 1: Summary

Example of a Con Edison Electric & Gas bill - page 1

Account information:

- Account number, customer address, type of rate, meter reading date.

Billing Summary

- Previous charges: charges from previous months which you have not paid yet.

- New charges: divided between your electric charges and your gas charges.

- Total amount due: the addition of your previous and new charges. The payment must be made by the 25th of the next month. In this example, the bill is for the month of december. It was sent to the customer around the beginning of the month of January. This customer has until the 25th (about 3 weeks) to pay the total amount due, or else he/she will be charges 1.5% of the amount due. In this case the amount due being $490.20, if does not pay before January 25th, he/she will be charges an extra $7.35 on the next bill.

- Message Center: since the customer did not pay his/her bill the previous month (the $207.86 outstanding balance for previous charges), an "adjustment" charge of $3.12 (1.5% of $207.86) has been added to the current bill.

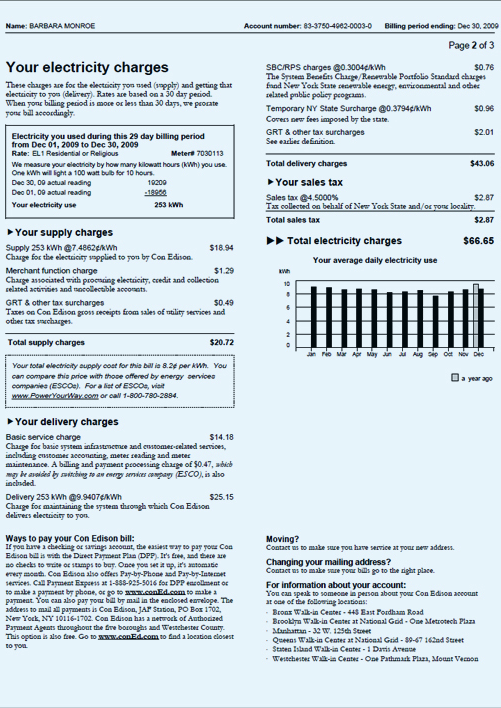

Con Edison bill - page 2: electricity charges

Example of a Con Edison Electric & Gas bill - page 2

Your Electricity Charges

- This introduction gives information about the dates between which the usage is being measured, and the amount of usage that has been read on the meter (253kWh).

Your Supply Charges

- Market price: this is the price that Con Edison charges you for the purchase of the electricity on the wholesale market, if you do not choose an alternate supplier. Since the price of wholesale electricity on the market varies at each instant, the market price given here is the average of the market price over the billing period.

- Merchant function charge: this is a charge for Con Edison's cost to procure the electricity (paying for the employees who buy the electricity, and their computers, offices, etc.). Con Edison will not bill you this charge either if you choose an alternate supplier.

Did You Know?The Electricity Supply charge together with the Merchant Function Charge can be compared with alternate supplier offers to get the best deal for electricity (and gas).

Call us at 1 (347) 410-8789 to find the best rates available in your area

- GRT & other tax surcharges (state surcharge): the gross receipts tax is similar to a sales tax, but it is taken by the state from the seller, Con Edison. Con Edison then charges you for the payment of this tax.

- Total electricity supply cost per kWh: by taking the total electricity supply cost ($20.72) and dividing it by the electricity usage during that period (253 kWh), you obtain the supply cost per kWh, which is 8.2¢/kWh. This is the price that you can compare with alternate suppliers in order to choose the best deal.

Your Delivery Charges

Your delivery charges pay for the cost of the utility company to deliver the electricity from the point of production to your place of residence. This includes:

- Basic service charge: this is a fixed amount. No matter your kWh usage, this cost will be the same fixed amount each month. This includes the cost for reading and maintaining the meters. Here the basic service charge also includes a billing and payment charge, which pays for the cost of producing, sending you bill and processing your payment. You can possibly avoid this charge when you switch to an alternate supplier, but this will depend on whether the supplier agrees to pay for this billing charge or not.

- Delivery charge: this is a charge per kWh, which pays for the maintenance of the grid used to transmit and distribute the electricity to your home.

- SBC charges (state surcharge): the System Benefits Charge is a charge which supports energy efficiency initiatives, education and outreach, R&D, and energy assistance for people with low-income.

- RPS charges (state surcharge): the Renewable Portfolio Standard is a charge which pays for renewable goals set by New York State.

- The Temporary New York State Surcharge is created to encourage the conservation of energy and other resources provided through utility companies.

- GRT & other tax surcharges (state surcharge): this is the gross receipts tax just like in the supply section.

Sales Tax

- The sales tax is worth 4.5% percent of the total amount due.

Total Electricity Charges

- The graph in this section will describe your monthly electricity consumption and help you manage your usage.

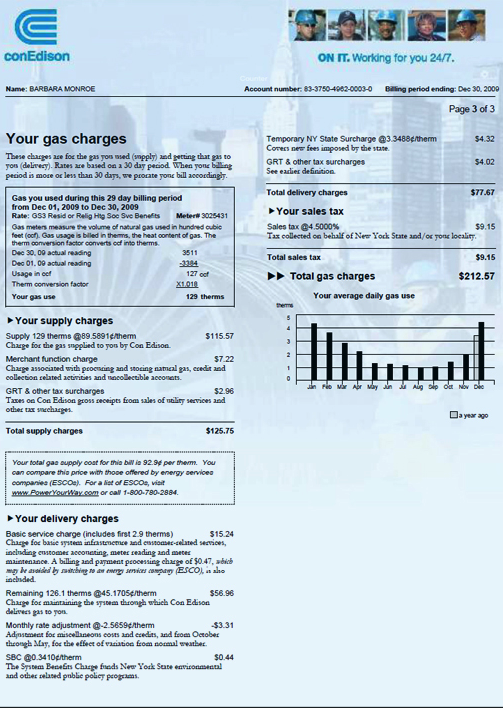

Con Edison bill - Page 3: Gas Charges

Example of a Con Edison Electric & Gas bill - page 3

Your gas charges

- This introduction, just like for electricity, gives the amount of gas that has been used, as read on the meter. The measurement unit for gas is a unit of volume, the ccf (centum cubic-feet, equal to 100 cubic feet. This measurement of volume is then converted into an energy value, the therm using the conversion factor 1.018. Indeed, currently, 1 centum cubic-foot of natural gas sold to you by Con Edison will have an energy of 1.018 therm. Therefore 127 ccf of natural gas will supply an energy of 129 them.

Your supply charges

- The supply charges for gas are structured the same way as for electricity: market price, merchant function charge, and GRT & other tax surcharges. Concerning the merchant function charge, just like for electricity, Con Edison will not bill you this if you choose an alternate supplier. The total electricity supply cost per kWh will in this example be 92.9¢/therm. You can compare this cost with alternate suppliers.

Your delivery charges

The delivery charges for gas are structured slightly differently from how they are presented for electricity.

- Basic service charge: for the first 2.9 therms of usage, the basic service charge is a fixed amount. The billing and payment charge for gas can also be possibly avoided if you switch to an alternate supplier, but this will depend on the supplier.

- Remaining 126.1 therms: this is a charge per therm, which pays for the maintenance of the gas network used to transmit and distribute the total gas usage, minus the first 2.9 therms, to your home.

- Monthly rate adjustment: this is a adjustment to stabilize costs caused by R&D, low income recovery, putting gas in storage, curtailment (due to shortage of supply) and other non-recurring events, as well as variations in demand from weather variations.

- SBC charges (state surcharge): see identical charge in electricity bill description.

- Temporary New York State Surcharge: see electricity bill.

- GRT & other tax surcharges (state surcharge): this is the gross receipts tax just like in the electricity supply section.

Your sales tax

- The sales tax for gas is also worth 4.5% percent of the total amount due.

Total Electricity Charges

- The graph in this section will describe your monthly electricity consumption and help you manage your usage.